Just about everyone in the United States knows something about the global financial crisis of 2008-2009. That particular crisis started in the U.S. housing and financial sectors and spread throughout the globe. In 2014, however, another global crisis occurred, one that was an echo of the last.

Recovery, globally, advanced sluggishly after 2010, with demand remaining below pre-crisis levels. Excess production capacity built before 2008, meant that some of the recovered GDP was actually being stored in inventories rather than liquidated to sales. Companies will often maintain excess production to maintain efficiencies. Eventually, maximized inventories led to production cuts and, by 2014, a massive drop in demand and price for the commodities used in production.

The US economy, based heavily on services and consumer spending, saw relatively limited effects from this. Russia’s economy, which is more heavily dependent on commodity exports, felt the crisis more acutely, especially when coupled with external shocks such as the conflict in Ukraine and resulting sanctions. The most significant effects included the ruble’s dramatic devaluation, low growth and even contraction of the economy, and the depletion of government reserves. How the government reacted to these developments, and how the Russian economy has changed in response, has been a fascinating history to watch unfold.

Causes

Russia’s economy, like that of the USSR before it, relies heavily on commodity exports, especially oil and gas, to fund government programs. Economists refer to this as Dutch disease, where a country focuses on resource extraction to the detriment of other industries. Thus, about 30% of Russia’s gross domestic product (GDP) and 60% of its exports depend on oil. In addition, given that the cost of producing a barrel of oil in Russia is relatively high, due to climatic conditions and overland transport distance to market, at around $40, the country extremely susceptible dips in oil prices.

In 2014, prices for most commodities dropped, but oil and energy prices plummeted, driven not only by reduced global demand, but also by increased production by countries like the United States and increased investment in renewable energy.

The conflict with Ukraine worsened the situation for Russia. In the short term, investors priced the possibility of a full-scale war into projects in Russia and . Longer term, sanctions have affected investments as well as access to capital by Russian businesses, which has hindered investment, and as a consequence, growth.

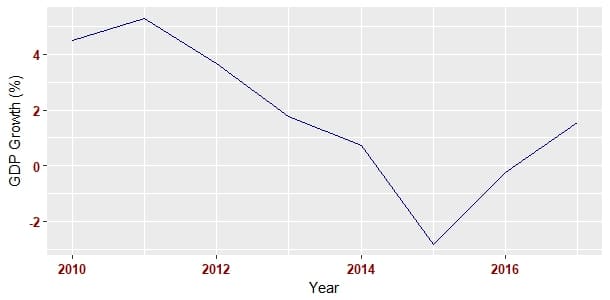

Despite this, Russia returned to growth relatively quickly with 0.3% in 2016, 1.5% in 2017, and a forecast 1.8% in 2018. Given that many major economies, such as the United States, are expecting approximately 2.5% growth for this year, Russia’s performance is, on the whole, surprisingly positive, especially considering the added geographic and sanctions constraints the country is under.

Sudden contraction and partial rebound in the Russian economy (Data from the World Bank).

Devaluation of the Ruble

One major issue brought about by the financial crisis was the devaluation of the ruble. The Russian ruble had operated with a currency band since 1997. This was instituted as part of agreements with international organizations like the World Bank and International Monetary Fund, who provided the massive international loans Russia needed as its economy imploded. As part of the agreements, Russia agreed to use the money lent to it, in part, to support its currency. Russia earned rubles but would have to repay in currencies like the US dollar or euro, so a stable exchange rate gave the lenders more assurance that Russia would be able to repay the loans it was given.

The Russian state maintained the band even after it had paid back its loans as Russian corporations also had international loans, and their ability to repay was contingent on a steady exchange rate. Over time, the difference between the real value of the ruble and the official value rose to nearly 100%, with the official rate at around 30 rubles to the dollar. Speculators did not move en masse on this information as Russia automatically bought or sold large amounts of currency with its oil wealth to keep the ruble in the band.

As economic pressures built in 2014, however, it became increasingly expensive to maintain the ruble’s worth and speculators increasingly applied more pressure, assuming that Russia would soon not be able to keep up. Indeed, voices with the government that had long argued against maintaining the band eventually won out and Russia allowed the ruble to “float” to its real market value.

Events came to a head on December 16, 2014, known as “Black Tuesday,” as the ruble suddenly plummeted. Sanctions and the falling price of oil, in combination with high demand for foreign currencies ahead of a large repayment of foreign-held debt, all contributed to the ruble’s sudden loss in value. The currency hit nearly 100 rubles to the dollar in the day’s trading.

Immediately after the crisis broke out, the Central Bank of the Russian Federation and the Russian government took steps to bring the situation back under control. Interest rates were increased to 17% and a major refinancing program was announced for major businesses with foreign loans. Furthermore, some restrictions on bank lending (such as reserve requirements) were relaxed and the amount of the reserve fund that could be tapped into was increased from about 500 million rubles to 3.5 trillion rubles. The government also tried and largely succeeded in convincing firms to sell foreign currencies that they held. This helped to prevent a run on the bank deposits and to assuage the fears felt by large players within the business community. Ruble rates fell almost as quickly as they had risen, stabilizing to the expected 50-60 per dollar range by the end of December.

The sudden drop in the Ruble’s value, visualized (Data from Bloomberg).

Counter Sanctions and Economic Pain

The transition to a free-floating ruble was not without pain. When a currency depreciates, it is able to be converted into less of another currency. In this context, it became more expensive for Russians to buy products and services that originated in other countries. Another symptom of Dutch Disease, common to commodity-exporting countries, is the tendency to import, rather than produce, most value-added consumer products. Thus, inflation soon began to quickly rise..

Food prices were also heavily affected. Russia imported most of its fruits and vegetables. Furthermore, the falling ruble encouraged Russian farmers to export more products abroad, leading to decreased supply in domestic markets and higher food prices.

Counter sanctions exacerbated the situation. Russia passed sanctions against those countries that had sanctioned it, focusing mostly on food imports. Suddenly, the logistics of Russian food imports had to be completely reconfigured, leading to immediate market disruptions and in many cases, skyrocketing prices.

The average person experienced decreased real wages and higher prices for food and most consumer goods. Furthermore, not all businesses or individuals that held debt issued in foreign currencies were included in the restructuring plans. These people and organizations now saw their level of debt double.

Inflation spiked to nearly 15% over the course of 2015, but has now fallen to post-Soviet lows, thanks in large part to the ability of Russian importers to quickly find new markets to draw from, massive investment into agriculture that came with rising prices and decreased competition, and prudent Central Bank monetary policy.

The Effect on Government Reserves

Strategically, the free float of the ruble was perhaps the most important decision made in creating the conditions for Russia to emerge quickly from its crisis. The fact that oil had rapidly lost nearly half its value caused part of the crisis. However, by allowing the ruble to float to its natural value, the Russian government was able to effectively double the number of rubles it was getting per barrel of oil. Inflation obviously ate into this windfall, but not enough to prevent the move from effectively stabilizing Russia’s income.

Russia also began to rapidly reform its budget expenditures, having seen what rapid moves in oil can do to its stability. From 2014 to 2018, through cuts and efficiency measures, Russia brought down its “breakeven point” from $98 per barrel of oil to just $54. Although it has disbanded its “rainy day fund,” which largely dried up during the crisis, Russia now puts any extra money earned beyond its budgetary needs into foreign currency and gold reserves. With rising oil prices, Russia’s reserves have recovered to nearly $460 billion and rising.

Furthermore, Russia’s current account trade balance remains positive and Russia’s budget is still in the black. Given all this, despite the prospect of additional sanctions, most international ratings groups are now putting Russia’s credit ratings on positive trajectories.

Central Bank Governor Elvira Nabiullina and Minister of Finance Anton Siluanov before a meeting with Russian Union of Industrialists and Entrepreneurs (logo in background) board members. Nabiullina and Siluanov were two of the major forces behind the reforms that have led to Russia’s recovery. Picture from Kremlin.ru.

A Problem for Every Solution?

While these policies have been effective in the short term, they may yet cause more problems in the long run. The depreciated ruble has made commodity exports more profitable and contributed to a prospering agricultural sector. However, it has also made importing the sort of technical equipment that Russia needs to upgrade its economy more expensive. This equipment is essential for further growth. Russia will be unable to produce such equipment on its own without major investment, which is more difficult to obtain financing for under sanctions. It might not even be able to import the equipment to make the equipment. Some in the business community worry that the short-term benefits of the weak ruble will only lead Russia to a “race to the bottom” with other countries that have inexpensive labor.

This weakness may exacerbate other issues Russia has on its midterm horizon, such as its need to modernize production to deal with what is forecast to be a rapidly shrinking labor force over at least the next decade. Further, Russia’s loss of access to western capital is also likely to further expose weaknesses in the Russian banking sector. Both the demographic issue and the weak banking sector are, in large part, heritage problems Russia inherited from the much larger crises it faced in 1990s.

Recovery

Russia’s economic outlook today is much more positive than it was just a few years ago. Oil prices have rebounded. This is a key development given how much of the economy still depends on oil and gas. The country also appears to have weathered Western sanctions for now, even getting a small boost from new sanctions on a different oil producer, Iran. Outside reports show positive indicators for the future. However, some structural issues still remain, such as dependence on commodities like oil, a shrinking labor force, and issues with the banking sector. Thus, the wise investor or mere interested observer would be well-advised to remain optimistic, but cautiously so, about the prospects for the Russian economy.